When buying a home, one of the biggest decisions you’ll face is whether to finance it through Pag-IBIG Fund or a Bank housing loan. Both options have their benefits and drawbacks, depending on your financial situation, employment status, and long-term goals.

Advantages of Pag-IBIG Housing Loans

- Lower Interest Rates for Affordable Housing

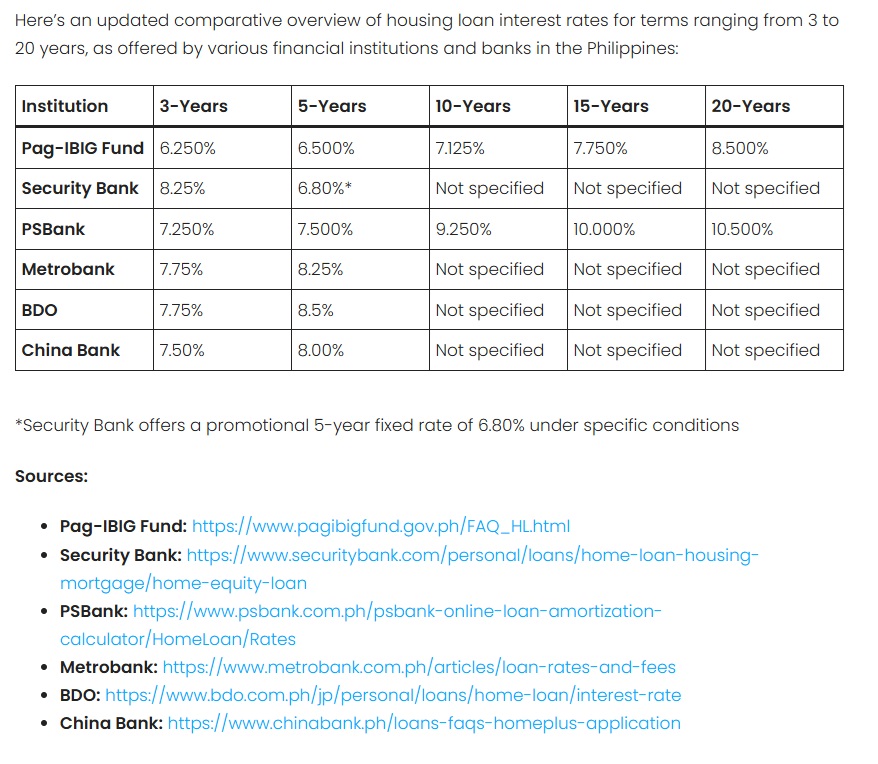

- Pag-IBIG offers fixed interest rates that are often lower than banks for affordable housing loans, especially for socialized housing borrowers.

- Their subsidized program provides rates as low as 3% for minimum-wage earners.

- Longer Loan Terms

- Borrowers can stretch payments for up to 30 years, making monthly amortizations more affordable.

- Easier Approval for Employees

- If you have been contributing to Pag-IBIG for at least 24 months, you can qualify for a loan, even with a lower salary or limited credit history.

- Lower Processing Fees

- Compared to banks, Pag-IBIG charges lower processing and appraisal fees, making it more accessible to first-time homebuyers.

Disadvantages of Pag-IBIG Housing Loans

- Longer Processing Time

- Applications can take weeks or even months to be approved, whereas banks can process loans faster. However, this timeline depends on the completion of all required documents.

- Limited Loan Amount

- The maximum loanable amount is ₱6 million, which may not be enough for high-end properties.

- Stricter Property Eligibility

- The house or condo must meet Pag-IBIG’s appraisal and requirements, and not all developers work with Pag-IBIG financing.

Advantages of Bank Housing Loans

- Higher Loan Amounts

- Banks can approve larger loans, making them ideal for buyers of mid-range to high-end properties.

- Faster Approval and Processing

- Bank loans are usually processed in 1 to 3 weeks, much faster than Pag-IBIG loans. However, this timeline depends on the completion of all required documents.

- More Flexible Loan Terms

- Many banks allow custom repayment structures, including balloon payments, step-up payments, and interest-only periods.

- Lower Rates for Short-Term Loans

- Banks often offer lower interest rates for 1 to 5-year fixed terms, making them attractive for short-term borrowers.

Disadvantages of Bank Housing Loans

- Higher Interest Rates for Long-Term Loans

- Banks usually offer lower rates for short-term fixed loans, but their long-term rates (beyond 5 years) can be higher than Pag-IBIG.

- Stricter Loan Approval

- Banks require a good credit score, stable income, and a higher debt-to-income ratio to qualify.

- Higher Processing Fees

- Bank loans often come with higher appraisal, notarial, and processing fees, increasing the upfront cost.

Who Should Choose Pag-IBIG?

✅ First-time homebuyers with lower income

✅ Those buying low-cost or socialized housing

✅ Employees who have consistent Pag-IBIG contributions

✅ Borrowers who prefer fixed rates for long-term stability

✅ Those who can wait longer for loan approval

Who Should Choose a Bank Loan?

✅ Buyers of mid-range or high-end properties

✅ Self-employed individuals or business owners who prefer bank financing

✅ Those who need faster loan processing

✅ Borrowers with a good credit score and stable income

✅ People who plan to pay off their loan within 5-10 years

The best financing option depends on your financial capacity, urgency, and property type. Pag-IBIG is an excellent choice for affordable housing and long-term stability, while bank loans provide faster approval and higher loan amounts for bigger property investments.

Before making a decision, compare rates and terms carefully, and choose the financing that best fits your goals.

Source: https://www.pagibigfund.gov.ph

Disclaimer:

The information in this article is for general informational purposes only. Interest rates, loan terms, and approval processes may change without prior notice. It is strongly recommended to check with Pag-IBIG Fund and individual banks for the most up-to-date rates and eligibility criteria. Loan approval is subject to the lender’s assessment of your financial standing.